Like all other competitions for resources, we can model this problem as a game and analyze it with economic game theory.

We have several players all attempting to maximize their individual profit, and they each have choices about whether to cannibalize.

We can, for the sake of analysis, view it as an iterative game.

In other words, there are distinct rounds, and a choice needs to be made each round.

There are several different mining pools in the Bitcoin network, but let’s focus on two theoretical pools: Pool 1, and Pool 2.

Each round, or iteration, is a case of the Prisoner’s Dilemma.

The Prisoner’s Dilemma refers to a problem of cooperation.

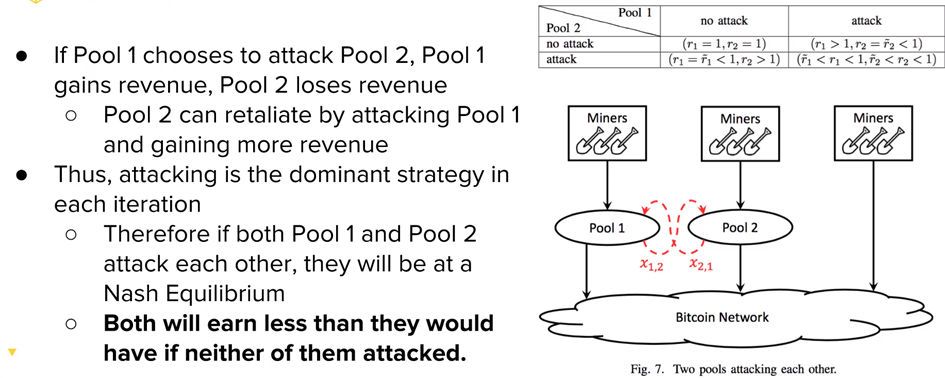

Pool 1 and Pool 2 both want to attack each other to increase their own personal profit at the expense of the other.

However, if they both attack each other, they’ll be worse off than if they both chose to cooperate and not attack at all.

Let’s say Pool 1 chooses to attack Pool 2.

Pool 1 increases its own personal profit, as demonstrated in the last section, but Pool 2 suffers.

So what’s to stop Pool 2 from retaliating to increase revenue? Well, nothing! Pool 2 has no reason not to attack Pool 1 back.

Because of this, choosing to attack is tempting for both pools.

In fact, we can formally say that both pools attacking each other is a Nash Equilibrium.

A Nash Equilibrium, put simply, refers to the choices that actors see as most profitable, as long as the others’ decisions remain unchanged.

Both Pool 1 and Pool 2 would not stop attacking, even if the other stopped attacking, because that would imply less profit for themselves.

However, if both Pool 1 and Pool 2 attack each other, they both lose mining power relative to the rest of the network.

This means that their profit from attacking is actually less than if they both chose not to attack each other.

So why don’t they just not attack each other and make more profit than in this Nash Equilibrium?

Well, the no-pool-attacks scenario is not a Nash Equilibrium.

In other words, if both pools choose not to attack each other, they’re not making as much profit as they could be.

There’s a more profitable option out there for them.

By attacking, they can increase their profit, and that’s what we’ve established all actors want to do.

Because of this, you fall into this issue where rational actors will eventually choose the Nash Equilibrium if they’re pursuing profit.

So, they’ll continually attack each other in hopes of making profit.

Sure, if pools adhere to a culture where they agree not to attack each other through cannibalization, then everyone benefits in the long run.

However, it’s not a guarantee that all pools will adhere to this: anonymously or not, nothing is stopping them at this point other than social constructs.

Except for the fear of getting attacked, there’s a large amount of incentive to attack other pools for profit.

Pools might be able to detect these attacks in the future, and detection of these attacks would allow for a long term solution, but as of now it’s still very difficult to detect.

We can’t always tell the origin of mining power, meaning that we either trust that we’re not being attacked or accept that there’s no solution to this problem.

Because of this, you can see the problem as a Tragedy of the Commons, in which all pools are individually incentivized to act in ways that do not as a whole improve the wellbeing of the entire group.

It all comes back to this issue of aligning personal incentives with group incentives.